Why Sailing Catamaran Insurance Premiums Have Increased Over the Past Few Years

In recent years, sailing catamaran owners have noticed a significant rise in insurance premiums, not to mention coverage limitations. Understanding the reasons behind these increases is crucial for both current and prospective catamaran owners. Several factors contribute to higher insurance premiums, which tend to be influenced by market dynamics and various cost drivers. There are, however, practical ways to potentially mitigate these rising costs that every catamaran owner should know.

The Rising Cost of Sailing Catamaran Insurance

1. Increased Number of Intense Natural Disasters

According to the Environmental Defense Fund in their article about climate change and hurricanes, “the most damaging U.S. hurricanes are three times more frequent than 100 years ago, and that the proportion of major hurricanes (Category 3 or above) in the Atlantic Ocean has doubled since 1980.” One of the primary reasons for the rise in sailing catamaran insurance premiums is this increase in frequency and severity of natural disasters. These natural disasters cause significant damage to boats, leading to more frequent higher value claims. Insurers, in turn, raise premiums to cover the increased risk and cost of potential payouts.

2. High Repair and Replacement Costs

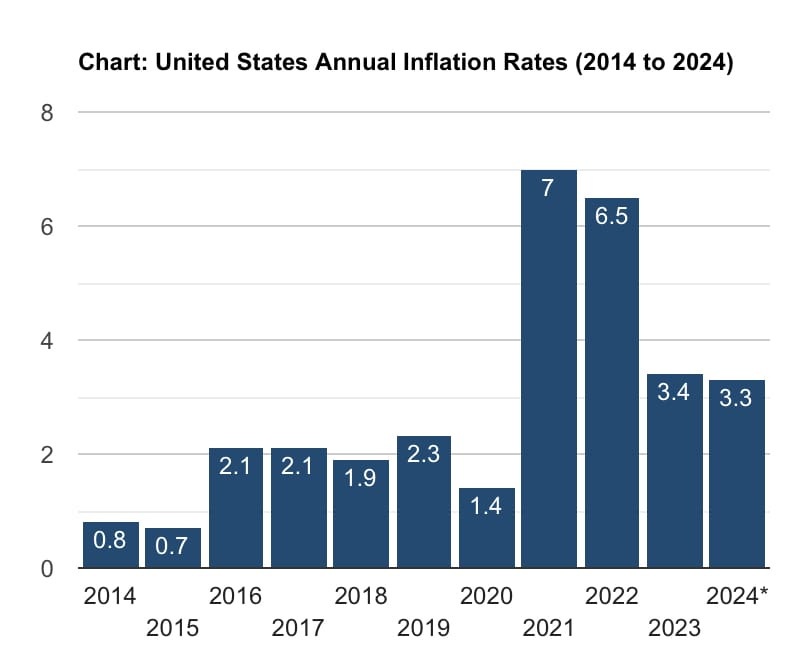

Sailing catamarans are increasingly complex vessels with specialized parts and equipment. The cost of repairing and replacing these components has risen dramatically due to recent inflation, supply chain disruptions, and technological advancements. For example, modern catamarans often feature advanced navigation systems, higher-tech sails, and advanced lithium and solar technology, all of which are expensive to repair or replace, especially in an elevated inflationary environment. These increased costs are factored into insurance premiums.

3. Increasing Hull Values

The value of sailing catamarans has been steadily increasing, in part due to inflation, but also due to the increase in demand (and limited inventory) experienced during the COVID-19 pandemic. As more people enter the market more quickly, inventory becomes more limited and demand drives up prices. Higher boat values mean higher replacement costs, which in turn leads to increased insurance premiums. Additionally, some new buyers finance their catamaran purchases, requiring more comprehensive insurance coverage as a condition of their loan, further driving up demand for more expensive insurance coverage.

4. Rising Medical and Liability Costs

Injuries and accidents on the water can lead to substantial medical and liability claims. Like many other industries over the past few years, the cost of medical care has also been rising, and this is also reflected in the insurance industry. According to the Peterson-KFF Health System Tracker, the average annual growth rate of spending per person on medical claims through private insurance has increased by nearly double since 2020 when compared to the average annual rate in the prior 10 years. Insurers account for these expenses, which boat owners will then see reflected in higher insurance premiums.

Market Dynamics Affecting Sailing Catamaran Insurance

1. Limited Competition

The marine insurance market is relatively niche, with only a few specialized A-rated insurers offering comprehensive coverage for sailing catamarans operating in both the U.S. and Caribbean. This limited competition can lead to higher prices as insurers have greater control over premiums. In 2018 there were at least 4 insurers if you sailed in both the U.S. and Caribbean. Today, all but 2 A-rated insurers have exited that market due to high claim volumes and profitability concerns, further reducing competition.

2. Regulatory Changes

Regulatory changes and compliance costs have also played a role in increasing insurance premiums. Stricter regulations around safety, environmental protection, and insurance practices require companies to invest in compliance measures. These costs are often passed on to boat owners in the form of higher premiums and limited coverage.

3. Claims History

The claims history of the sailing catamaran community affects insurance premiums. A high number of claims, whether due to accidents, theft, or natural disasters, can lead to higher rates. Insurance companies analyze historical data to assess risk and set future premiums accordingly. Unfortunately, recent years have seen a spike in claim frequency and values, contributing to increased costs for insurers, and as a result policyholders as well.

Tips to Manage and Reduce Sailing Catamaran Insurance Premiums

1. Define Your Use Case then Shop Around

One of the most effective ways to manage insurance costs is to understand your use case and coverage needs, then shop around. If you are American and plan to sail in both the U.S. and Caribbean, or you have a charter vessel, sadly your options may be extremely limited, with Concept Special Risks being one of the only A-rated carriers available. It’s still worth exploring options to find the best rates and coverage though. If you sail a non-charter vessel in the U.S. and limit sailing to less than 100 miles from shore, additional options may exist, such as State Farm which typically come with lower premiums and deductibles, plus expanded coverage. Working with a knowledgeable marine insurance broker, such as Hanham Insurance or Brown & Brown, can also help identify potential savings and tailor coverage to your specific needs.

2. Increase Your Deductible

Raising the deductible is a common strategy to lower insurance premiums. Not all insurers will offer this option, though if they do, agreeing to pay a higher out-of-pocket amount in the event of a claim, may lead to reduced premiums. However, it's important to ensure that the deductible is still manageable in case you need to file a claim. Ask yourself “how much can I afford to pay in the event of a claim before the financial impact would become unmanageable?”

3. Bundle Policies

If you own other types of insurance, such as home or auto insurance, consider bundling these policies with your sailing catamaran insurance. While not always available, especially if you’re sailing outside the U.S., insurers such as State Farm oftentimes offer multi-policy discounts that can lead to premium savings. Bundling can also simplify your insurance management by consolidating your policies with a single insurer and broker, who can then help manage your risk and coverages more comprehensively.

4. Maintain a Clean Claims History

A clean claims record can positively impact your insurance premiums. Avoid filing small claims that you can afford to pay out-of-pocket, as frequent claims can lead to higher premiums and limited coverage. By demonstrating responsible boat ownership and operation, and minimizing claims, you may qualify for lower premiums.

5. Evaluate Coverage Needs

Regularly reviewing and adjusting your coverage needs can help manage premium costs. First and foremost, ensure you’re not over-insured or paying for coverage you don't need. Secondly, be sure you have adequate protection for your catamaran's actual value and your personal liability. If you’re unsure of your sailing catamarans value, obtain an insurance survey from an accredited surveyor, or contact a licensed yacht broker to request a valuation. Tailoring your policy to your specific needs can result in more cost-effective coverage.

The Big Picture

The rise in sailing catamaran insurance premiums can be attributed to several factors, including increased natural disasters, higher repair and replacement costs due to inflationary spiking, rising boat values, and elevated medical expenses. Market dynamics, such as limited competition and regulatory changes, also play a role in shaping premiums.

While insurance premium increases may seem daunting, there are steps owners can take to manage and potentially reduce insurance costs. Shopping around, increasing deductibles, bundling policies, maintaining a clean claims record, and regularly evaluating coverage needs are all effective strategies.

By understanding the reasons behind the rising premiums and taking proactive measures, sailing catamaran owners can navigate the insurance market more effectively and ensure they have the necessary coverages through reliable insurers, at the lowest premiums.